The USO Anagnorisis

What has been happening in the oil market over the last month is fascinating and this is merely an attempt to crystallize some observations. This is not meant to be specific investment advice.

As the saga of “negative oil prices” finds its place in trader folklore, USO – the biggest oil related ETP stakes its claim as a stock character. For those unfamiliar with the instrument, the US Commodities Fund (USCF) runs the USO LP Fund, which, founded in 2006 is one of the most popular oil based ETF’s out there in terms of fund flow or Assets under Management (AUM). To borrow from Greek drama, this seems to be the Anagnorisis moment for investors. By definition, an Anagnorisis moment is “the point in the plot especially of a tragedy at which the protagonist recognizes his or her or some other character’s true identity or discovers the true nature of his or her own situation”.

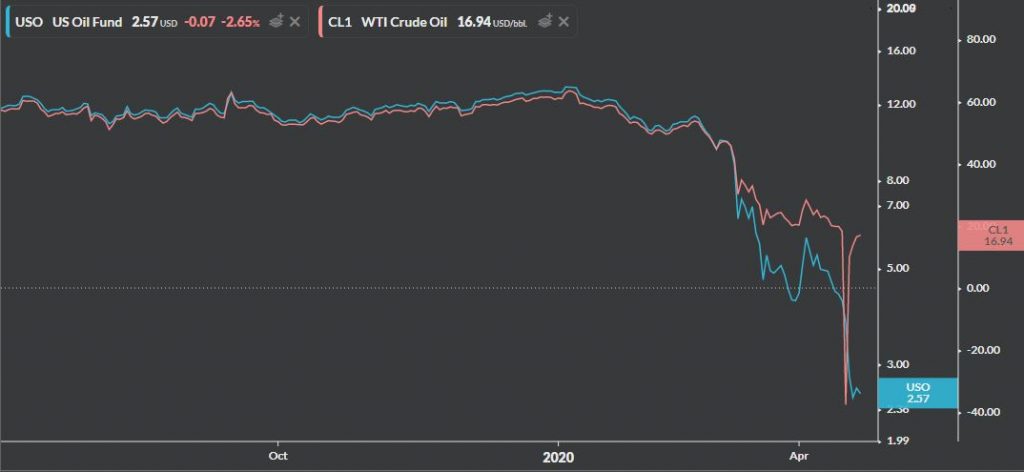

The current conundrum is how the ETF known to retail investors as THE instrument to go long Crude Oil ends up seemingly unhinged from the “underlying”. See chart below – the blue line is the USO Price:

The answer to the conundrum is right there in the prospectus for the USO fund and it turns out that the fund is not really a great proxy for a long term oriented investment approach tracking the spot price of oil. The USCF to their credit has been crystal clear on this – so this is more of a caveat emptor situation. This snippet below is from the USO prospectus:

The investment objective of USO is for the daily changes in percentage terms of its shares’ per share net asset value (“NAV”) to reflect the daily changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the price of a specified short-term futures contract on light, sweet crude oil called the “Benchmark Oil Futures Contract,” plus interest earned on USO’s collateral holdings, less USO’s expenses.

Investors should be aware that USO’s investment objective is not for its NAV or market price of shares to equal, in dollar terms, the spot price of light, sweet crude oil or any particular futures contract based on light, sweet crude oil, nor is USO’s investment objective for the percentage change in its NAV to reflect the percentage change of the price of any particular futures contract as measured over a time period greater than one day. This is because natural market forces called contango and backwardation have impacted the total return on an investment in USO’s shares during the past year relative to a hypothetical direct investment in crude oil and, in the future, it is likely that the relationship between the market price of USO’s shares and changes in the spot prices of light, sweet crude oil will continue to be so impacted by contango and backwardation. (It is important to note that the disclosure above ignores the potential costs associated with physically owning and storing crude oil, which could be substantial.)

Source: USCF Website

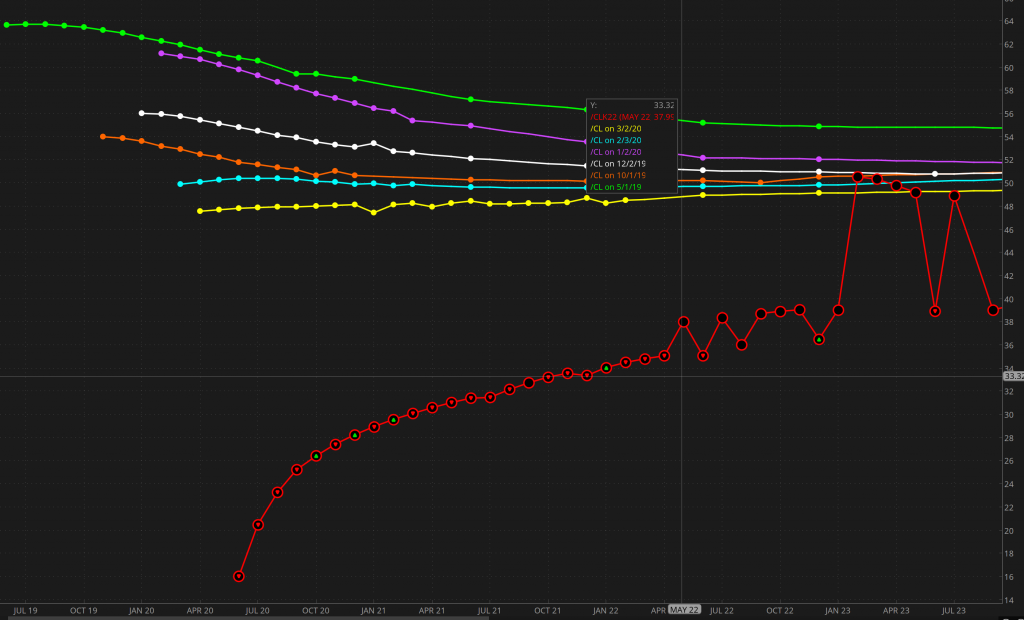

The key point here is that USO attempts to track the price movement of a short term futures contract and as such the performance of the fund is strongly dependent on the shape of the oil futures curve. The plot below is that of the current oil forward curve as of 4/26. The red line below is the curve as of 4/26 and the upward slope is indicative of the “contango”. What is a contango?

Contango is a market situation where the front month futures are priced lesser that future dated contracts – hence the upward sloping red curve in the chart above. The x axis is the month of the contract and the y axis is the price. The curves on top of the red curve indicate the futures curve at various periods over the last year so that you can get a gauge of the recent steepening. This is a reflection of the reality playing out more broadly where the near term demand has been decimated due to COVID-19, storage is difficult to find, freight rates are up, VLCC’s in demand etc. From a longer dated futures standpoint, the market suggests that there will be an eventual recovery of prices. Per the investment mandate of USO (which by the way has changed – more on that in short order), as the near term contract approaches expiration there is a roll- over to the subsequent month’s contract. When the oil forward curve is upward sloping (as in a contango) – the fund is in a position where it has to sell low and buy higher, creating a negative roll yield. This kind of works in reverse when the market is in backwardation and forward curve is downward sloping. Armed with this information on what is going to happen during roll time, traders and speculators may also front run this to some extent – though regulation has likely muted the impact of this relative to the 2008/2009 time frame when the same situation played out with a negative roll yield.

The other puzzle is the reason behind the absolute explosion of the AUM (Assets Under Management) for USO over the past few months. The same phenomenon has also played out in the 2008/2009 time frame. The AUM currently sits at $3.6B as of 4/24. It was up even further during the early part of the week. There is some evidence coming out of platforms like Robinhood and Sofi that retail investors was generally piling into the ETF from a bottom fishing standpoint. But, is that the only factor in play or are there other mechanics lurking beneath the surface that explains the increase in AUM? To answer this, it would help anchor to a basic understanding of how the ETF actually works. There are two concepts that are critical:

1) The Premium/Discount of the ETF’s Net Asset Value versus Share Price

2) Creation/Redemption Process and the role of Authorized Participants (AP’s)

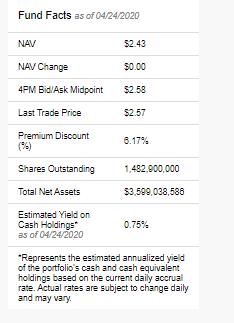

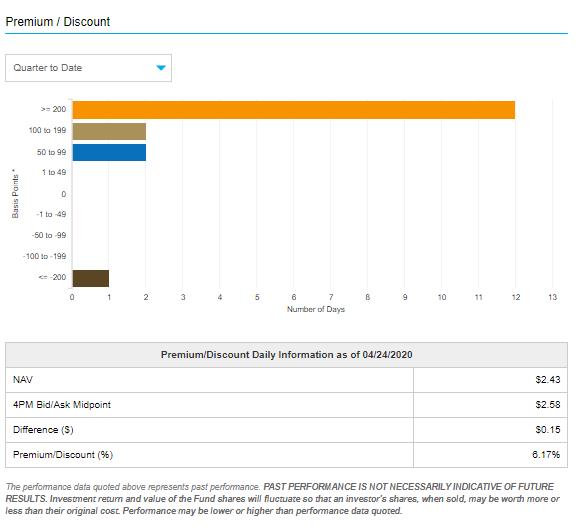

Let’s tackle the Premium/Discount first. There are two key parameters for an ETF. The Net Asset Value (NAV) and the Market Price. The Market Price is the share price that the ETF trades at on an exchange ( similar to the stock price). The Net Asset Value (NAV) is an end of trading day calculation where all the assets that the fund holds (including cash) is divided by the number of shares outstanding to get to a Net Asset Value number. In theory the market price and the NAV converge due to arbitrage mechanisms like the Creation/Redemption which we will tackle next but there are also periods where the NAV and the Market Price deviate, leading to a discount and premium of the ETF price relative to the NAV. To take USO as an example, here are some relevant data points to frame the ensuing discussion.

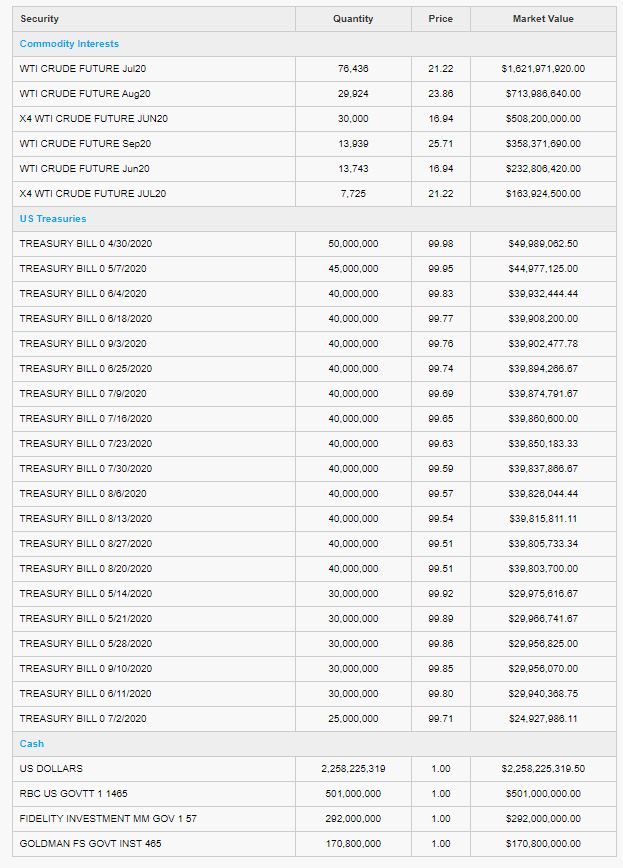

The table below illustrates the holdings of the USO fund as of April 24th. As you can see, due to the current market situation USO announced on April 16th that going forward there will not be a complete reliance on the front month futures but will go further out in the spectrum. This is reflected in the table below in terms of the commodity interests. This re-calibration is necessary to safeguard the value of holdings from going into negative territory.

As seen below is the premium discount spread:

Now, let’s look at the creation redemption process and the role of the Authorized Participants (AP’S)

As a backdrop, it is essential to start with laying out some basic similarities and differences between open ended mutual funds and exchange traded funds (ETF). In the former, the shares are not exchange traded and the demand for shares is fulfilled by a subscription and redemption process that happens during the end of day based on the fund’s NAV. ETF’s are traded on an exchange and the shares can be redeemed or created at the end of day based on investor demand, fairly similar to the open ended mutual fund. However, for ETF’s there are a group of institutional firms (hedge funds, banks, asset managers) who have a contract with the fund distributor to conduct the end of day trades. These special group of institutional firms are called Authorized Participants (AP)

Specific to AP’s for USO, this is the information sourced from the USCF website:

As of December 31, 2019, USO had the following Authorized Participants: ABN Amro, BNP Paribas Securities Corp., Citadel Securities LLC, Citigroup Global Markets Inc., Credit Suisse Securities USA LLC, Deutsche Bank Securities Inc., Goldman Sachs & Company, JP Morgan Securities Inc., Merrill Lynch Professional Clearing Corp., Morgan Stanley & Company Inc., Nomura Securities International Inc., RBC Capital Markets LLC, SG Americas Securities LLC, UBS Securities LLC, and Virtu Financial BD LLC.

Source: USCF Website

As described previously, the fund has a Net Asset Value )NAV) and a Share Price. When the Share Price is lower than the NAV(trading at a discount), the AP has the incentive to buy the ETF units in the market, deliver the same to the fund manager and at the same time get a basket of underlying to sell into the market. This is a basic arbitrage mechanism and helps keep a lid on the delta between the NAV and the share price. When the Share Price is higher than the NAV (trading at a premium), the process works in reverse. The AP’s buy the underlying contracts and deliver them to the fund manager, exchanging that basket for ETF units that are then sold in the market. Keep in mind that premiums happen on a relative basis – i.e premiums can occur when the demand for the ETF outdoes demand for the underlying. This can also happen when the demand for the underlying is decimated relative to the ETF – which is what happened to the May contract. This explains why the fund assets grew exponentially even when the underlying was collapsing. There was also the offloading of the relatively pricey ETF’s to retail investors who thought they were making an investment in USO expecting it to track an eventual rebound in spot oil.

Let’s talk about short selling next. ETF’s present a very easy way to short a basket of underlying. Last Tuesday, the uptick rule was triggered for USO that may have prevented some additional short selling. The uptick rule allows market participants to short an asset only if it is rising in price. Short selling can counter intuitively increase the number of shares outstanding via the “create-to-lend” process and this made short selling the USO immune to any share supply constraints. With the share price of USO at a premium to the NAV, there is an incentive via the creation redemption process described above for new share creation – essentially created to cover the short positions in the ETF and in effect supporting the naked shorts. This also explains the blow up in the share count exhausting the pre-registered shares.

So, what next?

- To avoid having to go through a regulatory process, the ETF manager usually pre-registers the shares to offer. However, due to excessive demand, USO suspended creation of new shares on April 21(essentially having run out of registered shares to issue). Due to this the value of USO is going to deviate further from the underlying (because the creation arbitrage mechanism referred to the prior paragraph cannot happen and the share price will most likely be at a premium to the NAV) and there will be a rise in trading costs.

- USO has filed with the SEC to register an additional 4 billion shares. USO will report via a Form 8-K on the effectiveness of the registration statements from the SEC.

- There is also going to be a 8:1 reverse split effective at close of trading April 28th. This is necessary to maintain listing requirements and for the share price to not go below 2$.

- USO may bounce back but it will be crucial for investors to pay close attention to: 1) Developments on the SEC filing for new share creation. 2) Equally important, watch the oil forward curve like a hawk to determine if the market moves from contango to backwardation. 3) Look at the actual assets held by the fund and how they are positioning themselves on the futures curve.

- The fine print always matter. But for investors in the USO fund, it matters more than any other time.

In closing this out, I just want to highlight that this subject has far more complications than what this quick blog post can convey. Hopefully this provides a perspective on the inner workings of this product. Stay safe and healthy!

-Krishna

Safe Harbor and Important Note: This post is not intended as specific investment advice of any kind. Past performance is not indicative of future results. Always consult your financial advisor for suitability of any investment