Decoding the Network- Advances & Investment Options

We live in an increasingly interconnected world and advances in networking keep pushing the envelope of applications geared to both enterprises and consumers. To put some of this in numeric terms:

- By 2023, there will be 5.3 billion Internet users (66% of global population), up from 3.9 billion in 2018 (51% of global population)

- By 2023, there will be 5.6 billion total mobile users (70% of global population), up from 4.9 billion (65% of global population) in 2018. The number of devices connected to IP networks will be more than three times the global population by 2023.

- By 2023, there will be 29.3 billion global devices and connections (3.6 devices and connections per capita), up from 18.4 billion devices and connections in 2018 (2.4 devices and connections per capita)

- By 2023, 45% of all networked devices will be mobile connected globally and 55% will be wired or connected over Wi-Fi.

- By 2023, nearly 11% of the global mobile connections will have 5G connectivity

- By 2023, the average global fixed broadband speed will be 110.4 Mbps, up from 45.9 Mbps in 2018, a 2.4-fold growth.

- By 2023, the average global Wi-Fi speed will be 91.5 Mbps, up from 30.3 Mbps in 2018, a 3- fold growth.

- By 2023, the average global mobile (cellular) speed will be 43.9 Mbps, up from 13.2 Mbps in 2018, a 3.3-fold growth.

- By 2023, globally, 5G speeds will reach 574.6 Mbps and will be 13 times faster than the average mobile connection

- By 2023, there will be 299.1 billion global mobile application downloads, up from 194 billion global mobile application downloads in 2018

“Source: Cisco Annual Internet Report, 2018 – 2023”

In the context of these advances, several networking related terms have been bandied about by the investment community; often interchangeably, sans an appreciation of the actual technical nuances underpinning the terminology. This alphabet soup includes SDN, NFV, IBN and SD-WAN. Without an understanding of what these mean (at least at a high level), investors may be flying blind in terms of the best investment opportunities, necessitating an over reliance on analyst ratings and financial metrics alone. On the other hand, just because a firm has bleeding edge technology does not automatically translate to a good investment opportunity. So what do these terms mean and what are some investment options that provide a basis for participation in some of these trends? Lets tackle each one in order.

Software Defined Networks (SDN)

Software Defined Networking (SDN) as a concept is not new and traces its roots back to the ForCES (Forwarding and Control Element Separation) protocol and the Ethane protocol, which then was elegantly funneled in the Open Flow protocol(2008). At the core of all these protocols was a fundamental decoupling of the hardware and control mechanics ( via software components). These efforts and some laudable championing by the Open Network Foundation paved the way for Software Defined Networking to flourish with some start-ups in the earlier part of the decade drawing some serious investor interest (Nicira, Big Switch Networks, Contrail and Vyatta to name a few). At the core of the SDN architecture is also the separation of the “control” plane from the “data” plane –what this largely denotes in simpler terms is that the software does more and the hardware does relatively less. Several incumbent hardware vendors like Cisco, Juniper and their ilk realized that a business strategy pivot was needed in terms of financial dependence on just the hardware side of the business that presented the risk of being a commoditized over time. Abstracting a lot of the erstwhile hardware functions into the software or control plane allows for more automated provisioning and policy oriented management of network resources. This also opens up the possibility of more deliberate integration with a plethora of cloud orchestration platforms. Managing remote sites by calibrated distribution and centralized control of compute capability, facilitating edge computing by optimal allocation of resources to reduce latency and thereby laying the ground for a more efficient IOT (Internet of Things) infrastructure are all possible with a properly configured SDN environment. SDN could also potentially improve the security posture of the network via segmentation – allowing different network segments to have different security settings depending on the sensitivity of the assets attributed to each segment. There is certain intelligence to how the network is managed. Just imagine a situation where you are part of a corporate video call and there is quality degradation due to network congestion. The intelligent software defined network could allow the bitrates to increase and can automatically avail of the highest bandwidth available and make that adjustment before any of the meeting participants are subjected to the lowered bit rate or quality degradation. In effect, the intelligent network is figuring out the best path for each packet factoring in several complex data points.

The diagram below depicts the standard SDN Architecture:

What to watch for?

Cisco has been at the forefront of this along with Juniper and VMWare and of late firms like HPE have made tremendous progress in terms of incorporating SDN as part of their hybrid cloud strategy. VMware was one of the pioneers of this movement and keeps giving Cisco stiff completion with the NSX and VeloCloud products.

Though it is hard to say in pure terms who will be at a disadvantage due to this phenomenon, one could make the argument that the physical footprint overall will be leaner. As such, for data center REITs and hardware vendors who do not make the pivot to a software oriented approach, this could be considered a net negative.

Network Function Virtualization (NFV)

Network Function Virtualization started as an effort by a telecommunication vendor consortium (ETSI Industry Specification Group) with the primary objective of simplifying end consumer offerings and provide for flexibility in managing the networks. The network functions are then placed on the virtualized network and off of commodity hardware, thereby reducing costs significantly including network operator opex as well as reduced power consumption. NFV provides a solid framework for the advent of 5G but there needs to further work done around the horizontal integration around the NFVI ( NFV Infrastructure) and how to containerize and enable more advanced edge computing. The NFV market is expected to grow from ~13B in 2091 to 36B in 2024, at a CAGR of 22.9%.

What to watch for?

The major players are: Cisco, Ericsson, Huawei, VMware and Nokia. HPE, Juniper Networks, Dell, Affirmed Networks and Netscout round up the next tier. Against the backdrop of security concerns and a lack of fundamental trust in utilizing cross-border technology (for now centered on Huawei), the work done by the O-RAN alliance (Open Radio Access Network) and the applications emanating from this technology become critical to monitor. The Nordic vendors (Ericsson and Nokia) may benefit at Huawei’s expense if this plays out in a larger context. Their balance sheets are not pristine but if they play their cards right, this could be a huge long term opportunity to gain some market share. In the RAN space, developments from smaller US vendors like Mavenir and Parallel Wireless are also worth following.

Intent Based Networking (IBN)

Intent Based Networking expands on the Software Defined Networking concept by viewing the intelligent network from a business use case perspective. For a business facing unit manager, irrespective of what the underlying technology “is”, what really matters is what the technology “does” for the user. If the bleeding edge network technology does not translate to a tangible business benefit for the user, then it loses its efficacy. This translation of intent from business to technology is one of the key pillars of IBN. As an example, for the finance function at an enterprise during the end of quarter or end of fiscal year cycle, the network needs to be intelligent enough to translate key business needs to a prioritized handling of network functions for the finance business unit so that there is no dip in service quality. The second pillar of IBN where there are parallels to SDN is the concept of activation/automation. The network and security policies are automatically created and applied to the network with a focus on optimization, security and reliability. The additive part is that techniques like Machine Learning and Artificial Intelligence are applied on the automation track to traverse through complicated scenarios and apply an outcome based approach to automation. Much of this relies on an awareness of the network formed by analyzing several historical data points ( learning) and then using that context to activate based on what is being observed closer to real time. The third pillar of IBN is assurance. Here again, ML and AI have a role to play to ensure that there is proactive monitoring and management of network resources to make sure that there is no dip in SLA’s. Also in play is a continuous feedback look to short circuit learning opportunities. In short IBN is an extension of the SDN paradigm to apply mathematical models/AI/ML to network management and orchestration. Interestingly enough, IBN can be applied on SDN and non-SDN architectures.

What to watch for?

Cisco is doing all it can to make sure it does not lose it enterprise IBN pole position with an additional overlay of “coherent” technology. Yes, yet another buzzword! Coherent technology allows for optical signals to send across long distances. With Cisco’s $2.6B acquisition of Acacia Communications, it has clearly signaled that optics play a key part from a pluggable standpoint in terms of increasing networking capacity and reduce complexity and costs. Cisco also recently bought Exablaze, a very interesting firm that has a FPGA based technology to reduce network latency. Two smaller private firms that I find really worth following are: Apstra Networks ( pioneering intent based analytics and some cool features in their latest product release) and Forward Networks ( utilizing a unique mathematical model for network verification). The other key vendors are Juniper Networks, Huawei, Indeni, Avi Networks and Gluware.

Software Defined Wide Area Network (SD-WAN)

SD-WAN is the next stage in the evolution of Wide Area Networks. The biggest shift in trajectory over the past 20 years has been the shift in enterprise application usage from a client server centric and largely on premise or data center oriented approach to a hybrid approach that encompasses SAAS applications and both the private/public clouds. As such, along cost and operational efficiency dimensions, it makes sense to not just look at let’s say an MPLS oriented infrastructure solution but also evaluate how to leverage broadband/4G/5G oriented solutions utilizing edge device capabilities. The MPLS approach is reliable but in terms of costs per bandwidth as well as set up time it is less than ideal in the present landscape. In short, the Software defined WAN approach allows an aggregation of a wide swath of network connections into an edge device at a branch location and has the intelligence to prioritize network traffic with active measurement and consideration of latency, jitter etc. Setting up the SD-WAN also allows for a ramp up to using cloud gateways sitting in the public cloud and avoiding “backhauling” (Backhauling referring to the direction of traffic first to the DC and then to the SAAS applications). The edge device under the SD-WAN aegis can utilize a secure tunnel and access the SAAS cloud apps with better visibility, performance due to the reduced hops. In terms of utility and adoption, SD-WAN owing to a crystal clear ROI discussion between the CIO/CFO is rightfully the technological evolution that is not just pie in the sky but is getting adoption right now, right here. According to IDC, 40 percent of global IT leaders surveyed say they’ve currently deployed SD-WAN; nearly 55 percent more expect to deploy within 24 months. Cisco for instance has numbers out that indicate that 70% of the Fortune 100 are using some form of Cisco’s SD-WAN solution (across its Meraki and Viptela products). With the understanding of the mechanics in play as articulated above it should become clear that the whole SD-WAN phenomenon becomes a second derivative play on enterprise cloud adoption.

What to watch for?

An emerging trend is a focus on an all in SD-WAN solution inclusive of Security. Fortinet, SonicWall, Barracuda are some firms at the forefront of this. Cisco (buying Duo) and VMWare( buying Nyasa) have made intentions clear in terms of their all-in SD-WAN strategy. Palo Alta Networks has also thrown its hat in the ring with the $420M acquisition of CloudGenix with the intent of integration with its Prisma product. In Cisco’s case, it will be interesting to see how this integration plays out relative to the Umbrella security suite and how Duo can help it achieve true zero trust security. The one additional consideration is the need for purpose built ASIC (Application Specific Integrated Circuits) in the realm of the encrypted tunnels (from the edge devices) mentioned above because IPSec based encryption can be a memory and processor hog. Also on the horizon would hopefully be a secure envelope to the containerized world (Kubernetes etc). Juniper Networks through its HTbase acquisition ( giving it the Juke container product) has been making some headway ( including a contract with IBM) in terms of integrating with their core Contrail product. In terms of market share leadership specific to the SD-WAN, VMWare, Cisco, Aryaka, Fortinet and SilverPeak typically round out the top 5 with Fortinet making some impressive progress over 2019.

| Acquired Company | Acquired Date | Deal Value | Integrated Under Product/Unit | Strategy Notes |

|---|---|---|---|---|

| Core Optics | 5/3/2010 | Cisco 8000 series | Optical Data Center Interconnect | |

| LineSider Technologies | 12/1/2010 | Cisco Overdrive Network Hypervisor | Network Management | |

| Lightwire Inc | 2/1/2012 | $271M | Cisco 8000 series | Optical Data Center Interconnect |

| Meraki Inc | 11/1/2012 | $1200M | Cisco DNA | Software Defined Network |

| Cariden Technologies | 11/1/2012 | $141M | Cisco Service Provider | Telecom services and network management, Optical convergence |

| Intucell | 1/1/2013 | $475M | Telecom Services | Self optimizing network softwarenfor carriers |

| Cognitive Security | 1/1/2013 | Cisco DNA | Advanced network threat detection | |

| SourceFire | 7/1/2013 | $2700M | Security Portfolio | Advanced cyberthreat monitoring solutions |

| Threatgrid | 5/1/2014 | Security Portfolio | Dynamic malware analysis | |

| Tail-f systems | 6/1/2014 | $175M | Evolved Services Platform | Network Service orchestration solutions (SDN/NFV) |

| Metacloud | 9/1/2014 | Open Stack as a Platform/Intercloud Architecture | ||

| Memoir systems | 9/1/2014 | IP used in several products | ASIC | |

| Embrane | 4/1/2015 | Application Centric Infrastructure (ACI), Nexus | LCM for ACI, SDN | |

| Piston Cloud Computing | 6/1/2015 | Intercloud | ||

| OpenDNS | 6/1/2015 | $635M | Cisco Umbrella | Advanced threat detection |

| Parstream | 10/1/2015 | SD-WAN | Data Analytics for IOT | |

| Lancope | 10/1/2015 | $452M | Cisco Umbrella/Security Everywhere | Advanced threat detection |

| Jasper Technologies | 2/1/2016 | $1400M | Cisco IOT | IOT Connect |

| CliQr Technologies | 3/1/2016 | $260M | ACI, UCS | LCM for Cloud Orchestration |

| Leaba Semiconductor | 3/16/2020 | $320M | IP, ASIC | Advanced Chip Technology |

| CloudLock Inc | 6/1/2016 | $293M | Cisco Umbrella/Security Everywhere | Cloud Access Security Broker |

| ContainerX | 8/1/2016 | Cloud Platform and Technology | Container Management Technology | |

| AppDynamics | 1/17/2020 | $3700M | IOT | SDN, IBN, IOT |

| Viptela | 5/1/2017 | $610M | Cisco DNA | SD-WAN |

| Observable Networks | 7/1/2017 | Security Everywhere | Cloud Security | |

| Springpath | 8/1/2017 | Hyperflex | Hyperconverged Data Platform,SDN | |

| Perspica Inc | 10/1/2017 | AppDynamics | ML, IBN | |

| Cpmute.Io | 12/1/2017 | CloudCenter | SDN,IBN | |

| Skyport Systems | 1/1/2018 | IP across products, Security Everywhere | Hyper converged Infrastructure and Security | |

| Duo Security | 8/1/2018 | $2350M | Cisco Umbrella, Security Everywhere | Zero Trust security |

| Ensoft | 11/1/2018 | Service Provider Networking | Network Service provider solutions | |

| Luxtera | 12/1/2018 | $660M | IP across products, IBN portfolio | IBN, Photonics |

| Singularity Networks | 1/1/2019 | Crosswork Network Automation | Networks Analytics platform, IBN | |

| Sentry | 6/1/2019 | IOT | IBN, IOT Security | |

| Acacia Communications | 7/1/2019 | $2600M | IBN portfolio | Coherent optics technology, IBN |

| Exablaze | 12/1/2019 | Complement Nexus portfolio | Ulta low latency FPGA technology | |

| FluidMesh | 4/1/2020 | IOT | Industrial Wireless backhaul solutions |

| Acquired Company | Acquired Date | Deal Value | Integrated Under Product/Unit | Strategy Notes |

|---|---|---|---|---|

| PacketMotion | 8/1/2011 | VMWare vCloud Networking and Security | User activity context for data access monitoring and network segmentation, including PacketSentry Virtual Probe, which monitors and enforces identity based network access controls in VMware vSphere as well as rich user access monitoring reports for compliance. | |

| CloudCoreo | 2/1/2018 | VMWare Secure State | Multi-Cloud Security | |

| Heptio | 11/18/2020 | Not clear yet | Container Ecosystem - Kubernetes | |

| Bitnami | 5/1/2019 | Not clear yet | Cloud/Container ecosystem support | |

| Avi Networks | 6/1/2019 | VMware NSX Advanced Load Balancer | Complete software-defined networking stack from L2-7 built for the modern multi-cloud era. Software load balancer, web application firewall (WAF), analytics and monitoring, and a universal service mesh. | |

| Uhana | 7/1/2019 | VMWare Telco Cloud and Edge Cloud | Deep learning to optimize carrier network operations | |

| Veriflow | 8/1/2019 | vRealize Network Insight | Network Monitoring and Diagnosis | |

| CarbonBlack | 10/1/2019 | $2100M | Not clear yet | Advanced threat detection and network monitoring |

| Pivotal Software | 12/1/2019 | $2700M | Not clear yet | Cloud/Container ecosystem support |

| Nyansa | 1/1/2020 | Intent Based Networking, AI based network analytics, SD-WAN |

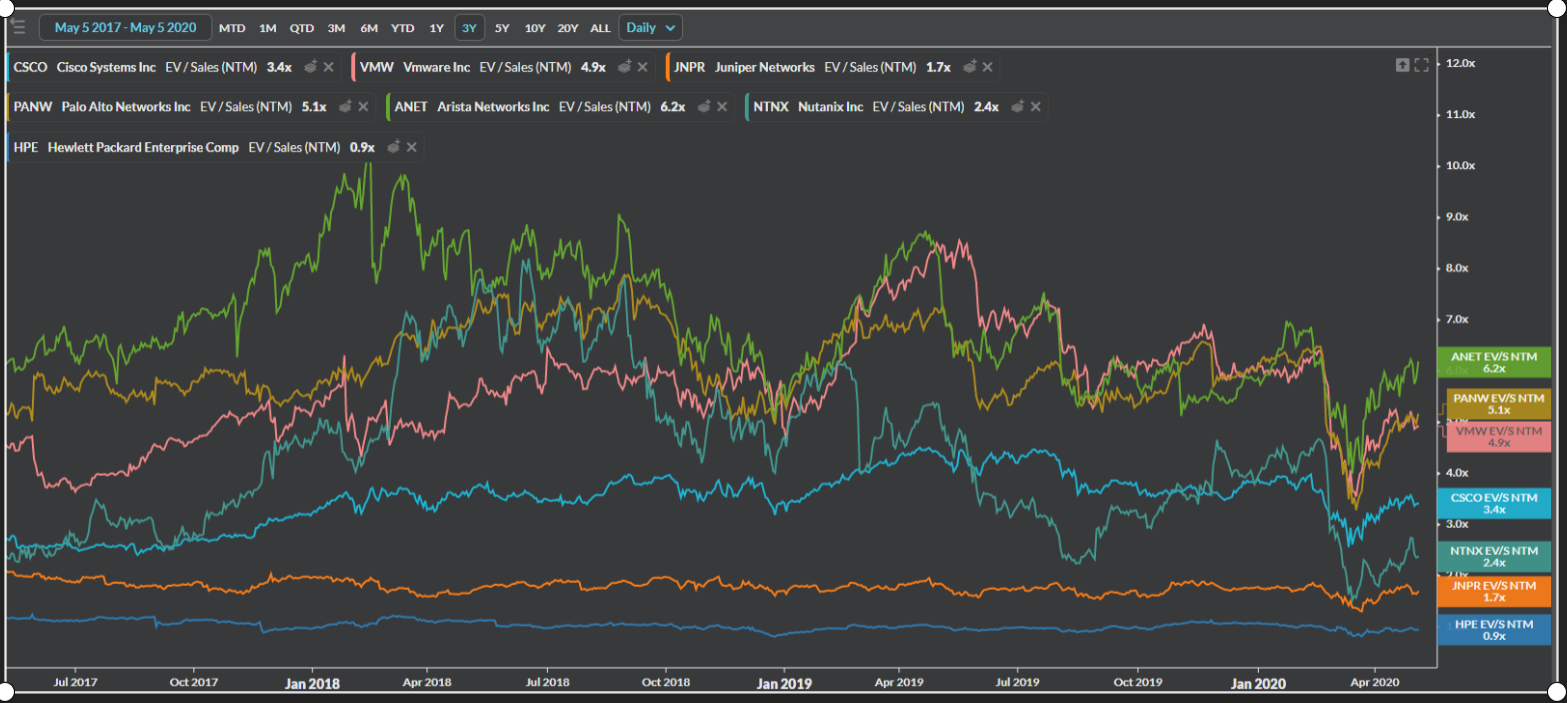

In Summary, across all the above themes, the one company that stands out is Cisco (CSCO). If you are looking strategically for an investment thesis to ride all these trends with relatively minimal earnings volatility, Cisco is that one option. As you move higher up the risk spectrum ( including both public and private firms), there are other options like VMWare, Juniper, Palo Alto Networks, HPE, Arista Networks, Dell, Ericsson, Nokia, A10 Networks, Apstra, Forward Networks, Gluware, Avi Networks, Indeni, Veriflow and Intentionet. Please reach out to me at Krishna@olivineresearch.com for detailed models and investment thesis surrounding these names including a Sum of the Parts Analysis of Cisco Systems.