-

The Memory Paradigm

Background

First some background: I have been positive on both Micron and Western Digital for several months now. This general positive sentiment was highlighted through the following LinkedInPost in August.

Well, this played out mostly as I expected. Micron is up close to 57% and Western Digital is up close to 51%. This thesis was punctuated by a run up on Dec 31st seemingly related to some source unverified news out of Samsung that DRAM Capex will mostly be unchanged and there will be an increase NAND Capex in CY 21. WDC rallied 11.83% while Micron was up 4.53% on 12/31. Micron reports earnings on Jan 7th. WDC reports in early February.

I generally like picking up both of these when the sentiment on the street is a little muted. Will have to wait til the earnings reports come out but would temper the enthusiasm, especially on Western till we know more. In the interim, here are some considerations and information that I hope you find useful in terms of assessing the memory industry and how things could shape up for the major players

Understanding the Memory Hierarchy

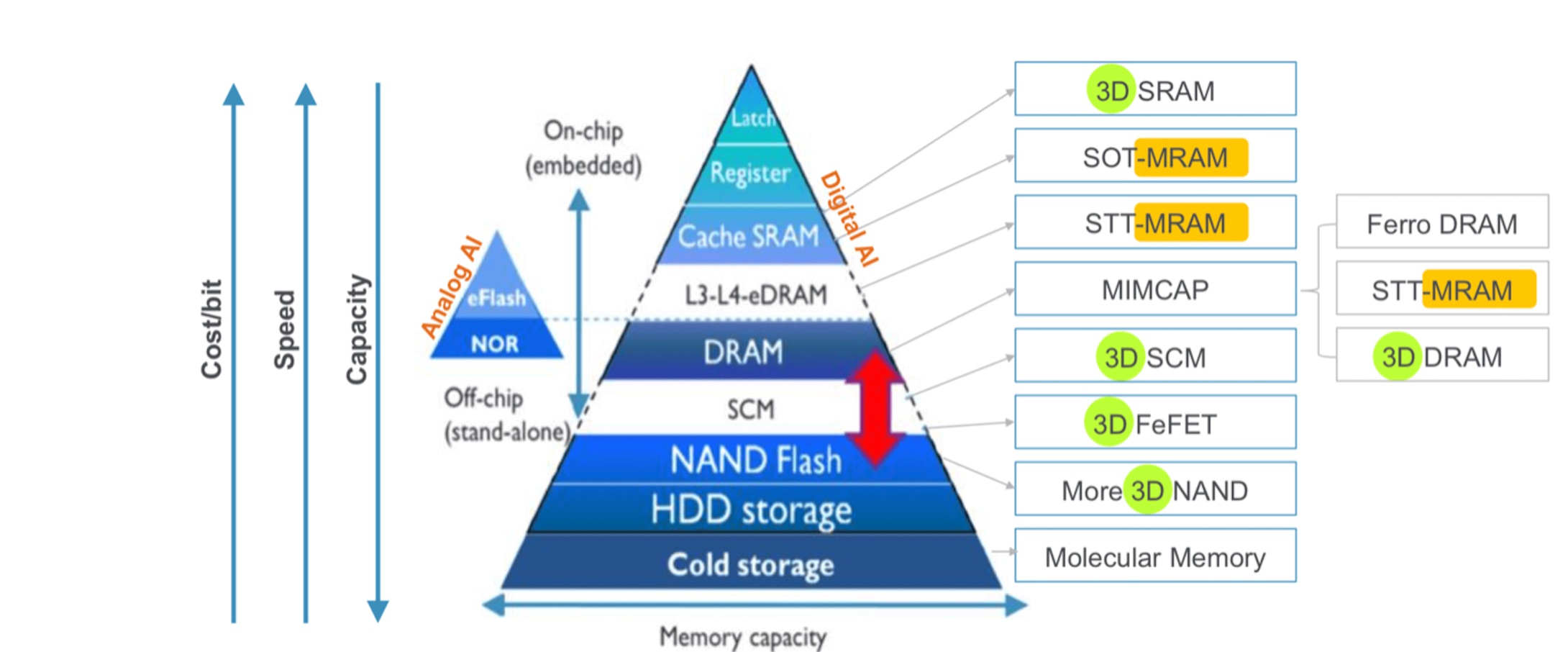

With the background out of the way, what I would anchor this post to is a general understanding of the memory hierarchy. To increase the odds of investing success in this sub sector, it pays to understand the technology at a non superficial level. If not, there will be an unhealthy dependence on Wall Street consensus and you may end up being late to good investment opportunities.At a very basic level, the diagram below often referred to as the Memory Hierarchy diagram, succinctly provides the different memory technologies and their specific attributes ( cost, speed, capacity).

Source: IMEC

SRAM (Static Random Access Memory)is on-chip memory meaning it is integrated into the processor. This is a volatile memory that uses a transistor and latch method (generally 6 transistors) to store bits and not capacitors. SRAM loses information when turned off but is faster than DRAM because there is no need for a refresh cycle ( due to the latching mechanism) or a write back for data retention. It is more expensive than DRAM due to the larger transistor footprint. There are some variants of SRAM like non-volatile SRAM and pseudo SRAM. SRAM finds itself a perfect use case as the on chip caching mechanism and a possible digital to analog converter on video cards. They key vendors are Cypress Semi Conductors ( now part of Infineon Technologies), Renesas and Samsung.

DRAM (Dynamic Random Access Memory) is located adjacent to the CPU in the memory module and constitutes the “main memory”. DRAM is capacitor based volatile memory and is cheaper than the SRAM. Performance is not as good as SRAM due to the need for constant refresh cycles and write back operations. DRAM generally holds the program code that is about to executed so that there is lesser need for “travel” to and from the CPU. There are different types of DRAMs like SDRAM, DDR2, DDR3, DDR4, DDR SDRAM and ECC DRAM.

Flash memory is a key underpinning of present day consumer technology ( finding use in smartphones, ) and is a non volatile type of memory. It is based on a floating gate single transistor technology. The bits are stored and retained by a “trapping” mechanism whereby the electrons are force held in the floating gate. Flash is fast and cheap but mainstream flash is not enduring and can be physically destructive across several cycles. Flash usually exists in two forms NOR Flash and NAND flash with the latter being the more prominent. NOR takes longer to write/access and usually serves as read only memory and embedded memory use cases. NAND, on the other hand provides more dense storage and faster write/access. NAND usually provides only block level ( and not byte level) access like NORs. With these characteristics, NAND is used in flash memory cards and solid state drives(SSD’s). Even within the NAND family, there are various classifications as is described below from the Micron product site.

NAND flash devices, available in 128Mb to 2Tb densities, are used to store data and code. Low-density NAND flash is ideal for applications like STBs, digital televisions (DTVs), and DSCs while high-density NAND flash is most commonly used in data-heavy applications like SSDs, tablets, and USB drives. There is a continuous effort to reduce the cost/GB of NAND devices, so device life cycles tend to be shorter with more frequent process lithography shrinks. NAND requires a controller, either internal or external, and specific firmware for error code correction (ECC), bad block management, and wear leveling.

There are two primary types of NAND: raw and managed. Raw NAND comes in different flavors, including single-level cell (SLC), multilevel cell (MLC), triple-level cell (TLC) and quad-level cell (QLC). Raw NAND requires external management but is the lowest cost/GB NAND flash available. Managed NAND incorporates memory management into the package, simplifying the design-in process.

Market Dynamics and Opportunity for Micron and Western Digital

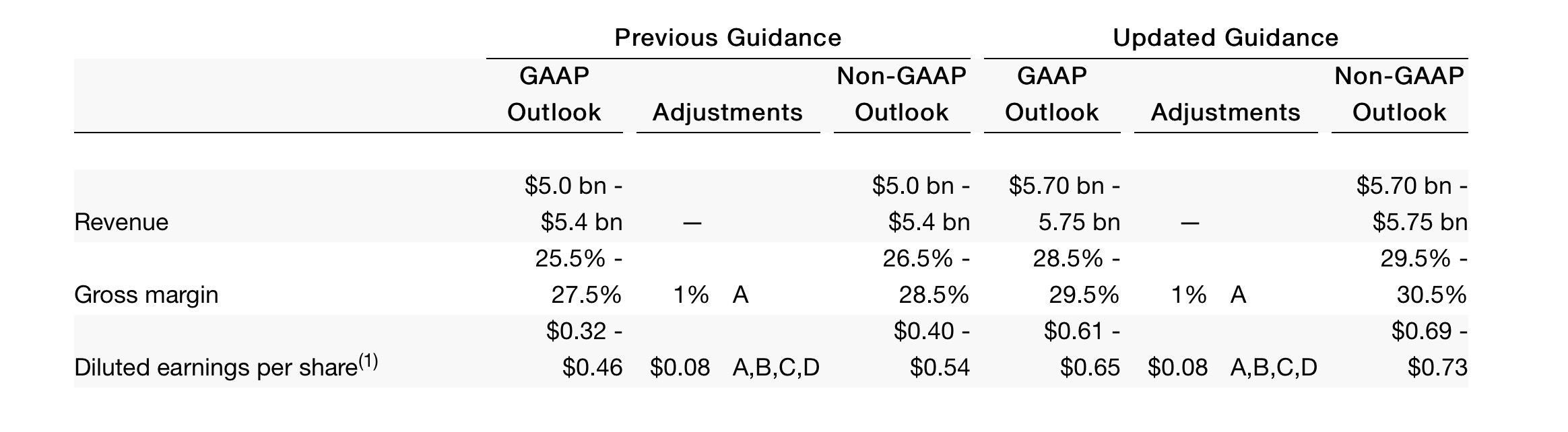

It is important to understand what the key revenue and profit drivers are for Micron and Western Digital, against the backdrop of all the underlying memory technology, use cases and competition.The most recent update from Micron was that it was upping its fourth quarter guide. As you can see from the table below – revenue, EPS and Gross Margin were all guided up. Micron saw strength across the board – in industrial, auto, PC and mobile. Enterprise continues to be weak. Both NAND and DRAM came in strong this quarter ( both volume and pricing). However, Micron did caution to not get ahead of reality on the NAND side for CY 21 owing to supply/demand dynamics.It is important to place in perspective the aspect that Micron generates more of revenue from the DRAM side ( about 60%) versus NAND. For Western Digital there is more of a dependency on the NAND side of things. Given the supply demand concerns around NAND in CY 21, the run up in Micron seems to be warranted and may have more room to run . And speaking of Western Digital, the one trend that may play out to WDC’s advantage over the next few years is the game console upgrade cycle and the need for additional storage alongside that refresh cycle.